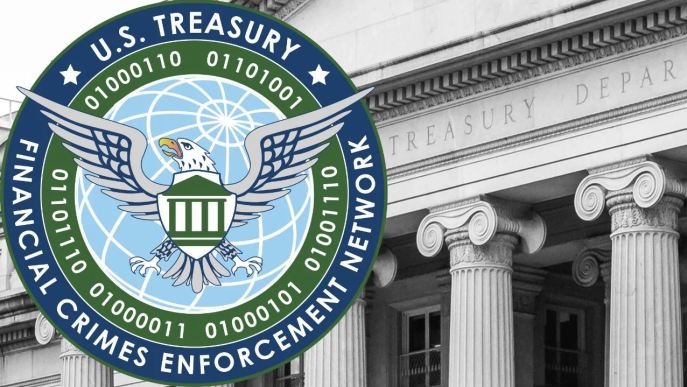

At this point we should have all heard about FinCEN’s Anti-Money Laundering rule, but details may still be fuzzy. Let’s break down the information available to prepare for what appears to be a new reporting requirement intended to go into effect December 1st, 2025! That’s right! As of this article, reporting obligations begin THIS YEAR!

FinCEN’s Anti-Money Laundering Rule applies to any non-financed transfer of any residential real estate to a legal entity or trust. This includes transfers that occur anywhere in the U.S., including Puerto Rico and overseas territories. Keep in mind that this rule covers “transfers” – not just sales. There is no minimum purchase price to trigger this reporting requirement.

There are several key words in this first sentence.

“Non-Financed” – Specifically, FinCEN is targeting transactions where there is no loan secured by transferred real estate, AND the loan is not made by a financial institution with an anti-money laundering program and an obligation to report suspicious transactions.

So, in the inverse, if you have a transfer that is a cash purchase or involves private equity lending or even hard money lenders, this will trigger the reporting obligation.

“Residential Real Estate” – What is residential real estate? This seems like it should be a pretty straightforward question with an expected response. Here are certain types of residential real estate that FinCEN includes within these regulations:

- A residential property with a 1-4 family structure

- Vacant land on which buyer intends to build 1-4 family structure

- Condo or co-op

- Apartment buildings or mixed use with a 1-4 family structure (existing or to be built)

However, how do you determine buyer’s intended use of the property? Will the inclusion of commercial aspects of use affect reporting requirements? We may not see many properties that combine residential and commercial use, but, especially in more rural areas, there are sites on which a business owner both lives and maintains a commercial structure such as a workshop or garage.

“Legal Entity or Trust” – This is pretty broad language. We can probably all agree on the most common types of entities that hold property, including corporations, limited liability companies, general partnerships and limited partnerships. These are easy to recognize in connection with a non-financed transfer or residential real property. The second part, or the “Trust” component of this term, is generally understood, as well, and is intended to include the basic understanding in South Carolina that, although a trust is a legal fiction, a trustee of a trust can hold title to real property in South Carolina apart from the individual rights of that trustee, the grantor/settlor or the beneficiary(ies) of the trust. For purposes of FinCEN’s rule, a transferee trustee does not include (i) a statutory trust); (ii) a trust that is a securities reporting issuer; or (iii) a trust in which the trustee is a securities reporting issuer. Other exclusions from FinCEN’s definition of trust transferee include a governmental authority, a bank or credit union and a public utility.

Exemptions!!!

There are certain exemptions to FinCEN’s reporting requirements under these regulations, including the grant, transfer or revocation of an easement or property subject to a reverse 1031 exchange1. Other exemptions may include:

- A transfer pursuant to the terms of Last Will, testamentary trust, by operation of law or contractual obligation following the death of an individual;

- A transfer incident to divorce order;

- A transfer to a bankruptcy estate; and

- A transfer supervised by a court in the United States (possible a forfeiture).

Who is the Reporting Person?

There is a list of priorities for who is to be the reporting person for purposes of these regulations. First is the settlement agent named on the settlement statement. FinCEN does not note a difference between an attorney settlement agent and a non-attorney settlement agent. The second choice for a reporting person is the person that prepares the settlement statement. The third choice is the person that records the deed in the public records. The fourth option is the person that issues the owner’s title insurance policy. Fifth is the person that dispenses the greatest amount of funds. Sixth choice is the person who examined title and the final and seventh option is the person that prepared the deed.

I can imagine so many unforeseen and unexpected problems arising from placing reporting obligations upon the individuals that might find themselves on the foregoing list. Other than a settlement agent, or perhaps the person preparing the settlement statement if that person has been specifically allocated the duty to report under these regulations, these individuals could be people that have never heard of these regulations or the type of reporting requirements that have now been legally assigned to them. A prime example could be a deed from a parent as grantor to a family estate planning entity or other estate planning transfer where a real estate attorney might not be involved. If there is no settlement agent and no settlement statement prepared, as between the parties (grantor/grantee/trustee?), whoever records the deed now has the obligation to report this transfer to FinCEN.

What must be reported?

There has been a lot of discussion of what type of beneficial ownership information must be reported and disclosed, so I won’t go into that in this article, but what other information must be reported? Certain payment information must be reported to FinCEN under these regulations including (i) the amount of any payment made, (ii) the form of payment, (iii) the name of the payor if the payor is not the transferee entity or trust and, (iv) if the payment comes from a financial institution, the name of that institution and the account number.

When must the report be submitted? The report is due to FinCEN by the last day of the month after the date of closing. For example, if the transfer occurs on February 28th, reporting is due by the last day of March that same year. However, it is particularly important to gather all information needed for a full and complete report prior to closing. We know once the transfer is complete, it is difficult to get additional items from the parties to the transaction. However, when pressed by ALTA for a “good faith” basis of approval for a partial or incomplete report, FinCEN did not bite. FinCEN maintains that their “Reasonable Reliance Rule” addresses concerns over difficulty to obtain all information necessary to fully report the transfer.

What is the Reasonable Reliance Standard/Rule? FinCEN says that absent knowledge of facts that reasonably call into question the reliability of the information provided, a reporting person may rely on information provided, including buyer’s intended use of the property (for residential purposes?) and for lenders’ qualifications (do they hold themselves out to have an AML program and be subject to obligatory reporting?). However, BOI must be certified to the reporting person!

What if you do not report under these regulations? Violations of these regulations include both civil and criminal liabilities and penalties. These are the normal violations and penalties under general FinCEN regulations and not special to the AML Regulations but can be severe. Criminal penalties can result in financial obligations and prison time and civil penalties, which accrue for each separate willful violation range from $25k to$100K and violations for negligence are not to exceed $500 or $50k if a pattern of negligence is found. This is not all-inclusive of the repercussions for violations of these reporting regulations, but definitely something to get your attention!

How can we prepare?

Although we do not have FinCEN’s final real estate report that real estate professionals can use to report information for each covered transfer, as I stated at the beginning of this article, the reporting period begins December1, 2025. This means that people involved in residential real estate transfers to legal entities or trusts that may not involve financial institutions subject to federal anti-money laundering programs and reporting duties need to begin studying these regulations and to afford time and resources for training to know what information to collect, how and from whom to collect it, and how and when to report it.

- While there may be an exemption in a standard 1031 exchange depending on the deal specific facts, this potential exemption is intended for reverse 1031 transactions where the replacement property is transferred to an entity accommodation titleholder during the course of the overall 1031 exchange transaction. ↩︎